With the increasing presence of alternatively fueled vehicles on our roadways, we must ensure

everyone is paying their fair share.

• While the alternatively fueled vehicle market is small today, it is expected to grow exponentially over the next several decades. Legislation is needed to ensure we recoup as much of these dollars as possible for needed transportation investments.

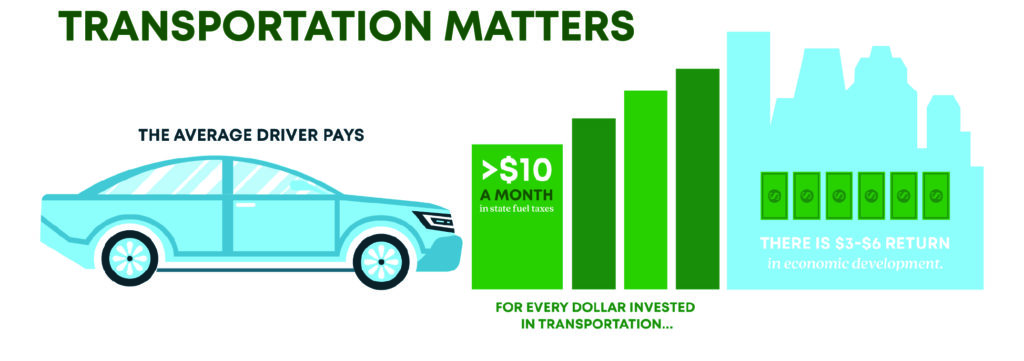

• Per-gallon motor fuel taxes paid by road users historically have covered a good chunk of highway costs. But the state gas tax has been stuck at 20 cents per gallon for 30 years. Gas tax revenues also cannot keep pace with vehicle use and rising highway construction costs. As cars and trucks grow more fuel-efficient and electric vehicles become more popular, per-gallon tax collections shrink relative to miles driven on Texas roads.

• Projected near-term revenues are about $55 million, but that number will grow with Texas’ electric vehicle usage.

• Texas needs to prepare for a transportation future that is less reliant on petroleum. Authorizing this new revenue source would begin to reconcile Texas transportation funding with the future of 21st-century mobility. Experts agree that the future will be increasingly shared, electrified, and autonomous, and it will demand new approaches to funding and investing in transportation.